do nonprofits pay taxes on lottery winnings

Answer 1 of 8. Rather than an income.

Preparing A Client To Claim A Lottery Jackpot Wsj

And you must report the entire amount you receive each year on your tax return.

. Up to 13 can be withheld in local and state taxes depending on where you live. The typical winner of Canadas lottery casino or game of. But you may not actually owe that tax.

The IRS takes 25 percent of lottery winnings from the start. Whenever you see a dollar from a lottery win please remember that the IRS has taken its 25. But nonprofits still have to pay.

All winnings from the lottery are subject to tax but its not as simple as paying for it the year you won. You may get some or all of the. That means your winnings are taxed the same as your wages or salary.

If you win in 2020 and give the winnings to a public charity you can claim a deduction for 100 of what is basically your adjusted gross income. Gambling and lottery winnings is a separate class of income under Pennsylvania. Here are the 10 states with the highest taxes on.

The nonprofit doesnt have to pay tax on either lottery winnings that it paid for or on contributions from the Pool members. You must report any. Up to 25 cash back To prevent abuses and tax evasion the IRS imposes some strict requirements on nonprofits involved with gaming activityfor example.

For both federal and state tax purposes lottery winnings are treated as ordinary taxable income. Taxes related to winnings from gambling are significantly different from taxes in the United States and Canada. So even if you could direct your winnings into a trust fund to avoid paying taxes that 25 percent would be withheld.

Section 671b of the Tax Law and Section 11-1771b of. If you take its annuity value youll have to pay taxes every year. For example if you are single and have a taxable income of 40000 and win a 1 million lottery your total taxable income would increase to 1040000 for the year if you take the payout as a.

Out of the 43 states that participate in multistate lotteries only Arizona and Maryland tax the winnings of people who live out of state. This is a special COVID. Gambling and Lottery Winnings do seniors pay taxes on lottery winnings Class of Income.

Yes nonprofits must pay federal and state payroll taxes. For example lets say you elected to. Therefore your winnings are taxed the same as your wages.

The Federal tax on lottery winnings 2018 the top tax rate was lowered down from 396 to a total of 37. In the United States it is common for state and federal taxes to be withheld from lottery winnings. If youre a UK tax resident youre exempt from paying the following taxes on your lottery winnings.

Your recognition as a 501 c 3 organization exempts you from federal income tax. It means that is you luckily win a lottery in the USA this year.

How Much Can You Give To Charity Tax Free If You Win The Lottery

Meliponamaya Org Meliponamaya Org

Some Insight Into Lottery And Gambling Taxes Powerball Lotto Tickets Winning The Lottery

The Top 12 Biggest Jackpot Winners Of All Time

/cdn.vox-cdn.com/uploads/chorus_asset/file/5902101/shutterstock_254400031.0.jpg)

Lottery Winners Should Start A Private Foundation No Really Vox

How Much Can You Give To Charity Tax Free If You Win The Lottery

Tax Strategies For Lottery Winners

If You Win The Lottery And Donate It All To Charity Do You Owe Taxes Quora

You Won The Lottery Here S What You Should Do Now Gordon Fischer Law Firm

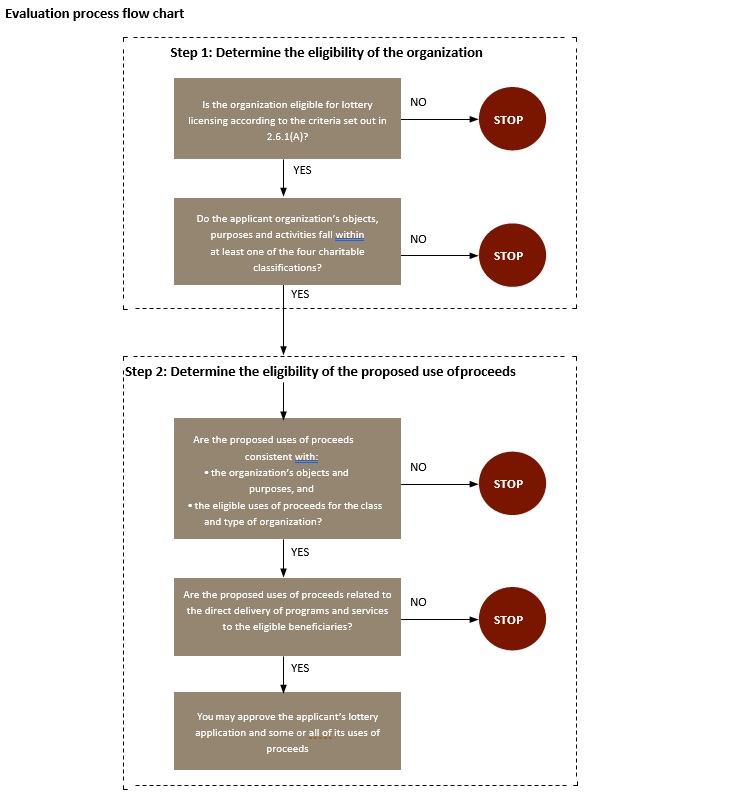

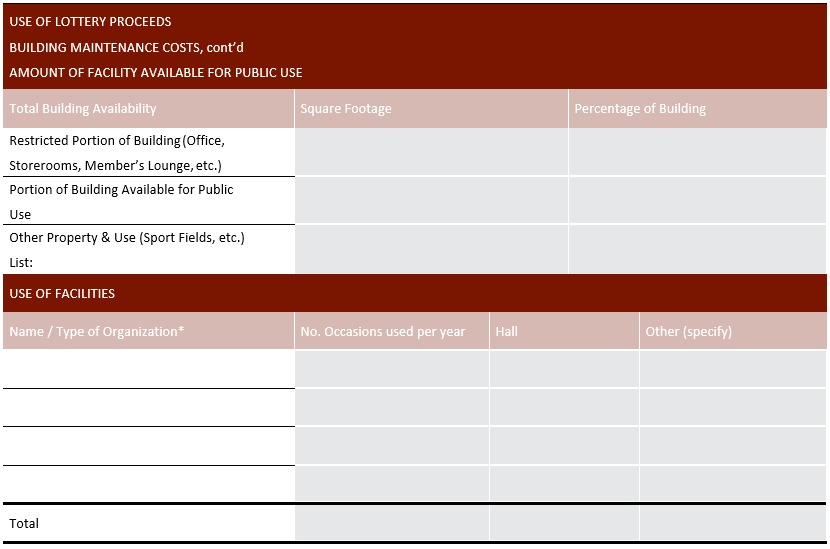

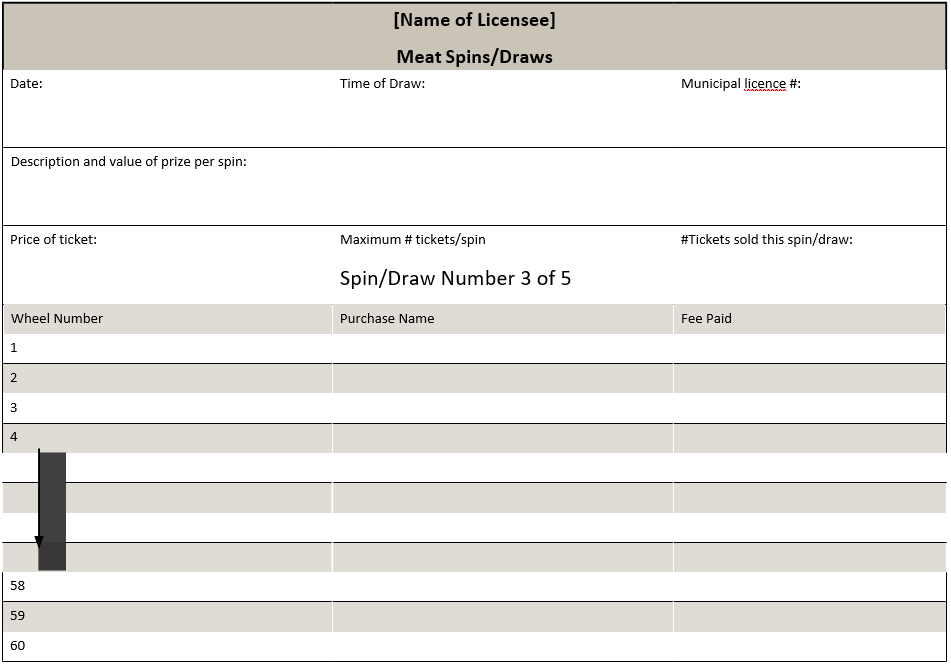

Lottery Licensing Policy Manual

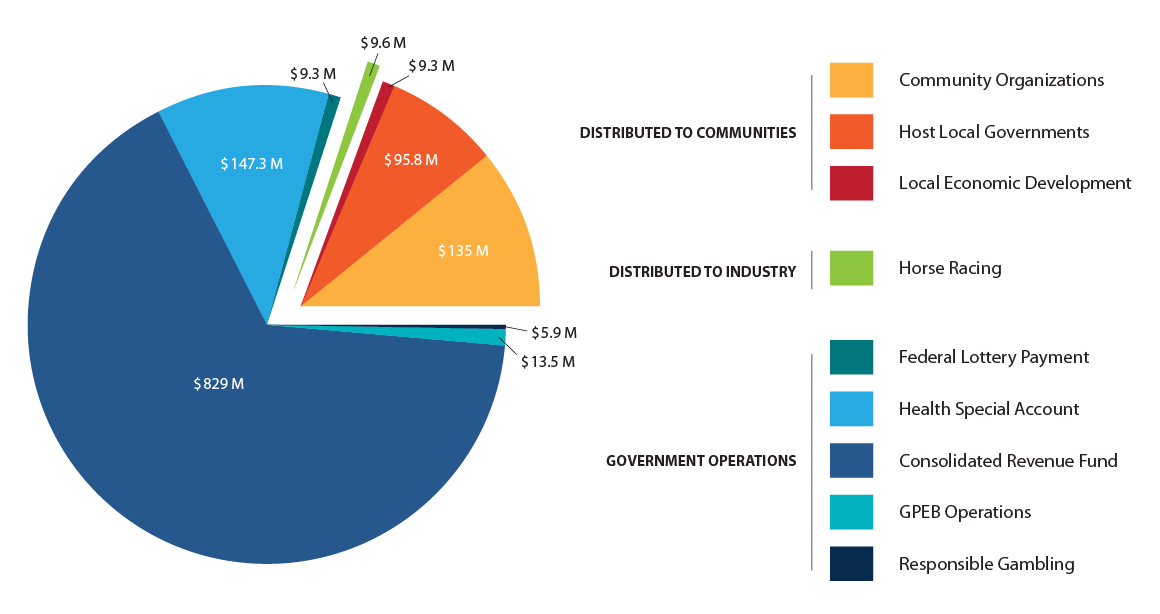

Gambling Revenue Distribution Province Of British Columbia

Lotteries Casinos Sports Betting And Other Types Of State Sanctioned Gambling Urban Institute

5 Things To Consider If You Re Playing The 1 1 Billion Mega Millions Crain S Detroit Business

Lottery Licensing Policy Manual

Monday Map State Local Taxes Fees On Wireless Service Infographic Map Online Lottery Lottery

Lotteries Casinos Sports Betting And Other Types Of State Sanctioned Gambling Urban Institute

Fillable Form 1040 Schedule C 2019 Irs Tax Forms Tax Forms Credit Card Statement